40+ credit union mortgage vs bank mortgages

Banks are for-profit which generally but not always means higher rates and fees. Lower rates Easier approval Smaller down payments Local and regional expertise More assurance and control Each credit union may vary somewhat in their process so the best way to begin is talking to a home loan expert.

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Different lenders offer different terms and sometimes credit union mortgages carry lower fees such as closing costs and origination fees than banks.

. Theyre exempt from paying federal income tax which means they can prioritize breaking even over making a profit. What About a Bank. Web Flagstar Bank offers all the major mortgage options conventional jumbo construction and government-backed loans both online and at its branch locations in Indiana Michigan Ohio and Wisconsin.

Web Credit unions will give out mortgages but heres the thing. These rates do not hinder your financial flexibility. As a member of a credit union you can take advantage of lower fees better rates and superior customer service.

Cardholders enjoy a complimentary year of Amazon Prime a reasonable 999 to 1800 variable APR and up to 100 credit. Those factors in the credit union vs bank decision can add up fast. Information provided assumes the loan purpose to purchase or refinance single-family primary residence in California with a loan to value at or below 60 with an assumed credit score of 740.

Lower interest rates reduce monthly payments and can save you thousands over your loan term. The lending company has got the discernment to choose whether or not to require the borrower to add a secured asset once the guarantee with the mortgage secured loan or stretch the mortgage without having. That different perspective leads to typically lower rates and more affordable loans a strong point in favor of credit union membership.

Easier approval processes All other things equal credit unions are more likely to lend to someone with a less than optimal credit score andor history. We have picked out a few below. Adjustable rate Mortgages are variable and your rate may increase after the original fixed-rate period.

Credit Unions Tend to Be More Personal. Web When considering credit union versus bank mortgage loans you should evaluate the differences too starting with their structure. Banks are on average 13 times larger than credit unions with 26 billion in assets vs.

Web Because credit unions typically have a smaller customer base they tend to have less cash on hand to loan out which may curtail loans available. Web When you apply for a mortgage loan with a credit union youre more than just a number youre a member. 207 million in assets for credit unions.

Plus banks are more likely to sell mortgage loans to a third-party loan servicer. Web Credit union mortgages may come with advantages such as lower fees and interest rates. Web As you compare mortgage programs and mortgage interest rates be sure to look into the mortgage fees associated with applying for a mortgage such as the origination fee document preparation fee appraisal fee credit report fee title fees and other closing costs.

Banks usually have more brick-and-mortar locations which makes branch locations easier to find. On the other hand a credit union only needs to cover its costs and generate value for its members. If youre approved for a credit union mortgage the lender.

Over the past decade credit unions have been more likely to provide. When you take out a mortgage you tend to hold it for 10 15 even 30 years or more. Youve made a lot of progress in the home buying process.

The Federal Reserves aggressive campaign to bring down inflation helped set the stage for major problems at two California lending institutions SVB. Web Banks are more likely to charge you a higher interest rate especially in relation to your credit score. If you are a member theres a good chance you might have lower closing costs and a better interest rate.

Web Because credit union membership tends to be smaller and more local bank customers may receive less personal service especially when using a branch outside their more typical one perhaps while traveling. Web Getting Mortgage from Bank vs Credit Union A credit union guarantees lower fees and interest rates be it mortgages credit cards personal loans or other financial products Credit unions often offer lower interest rates and APR compared to the average bank. Web When shopping around for a mortgage compare products and rates at credit unions as well as banks.

Web In general credit unions are more likely to lend to buyers with lower credit scores and offer lower down payment options. Credit unions can offer these benefits and more because they are not-for-profit organizations. Web There are several advantages of a credit union mortgage as opposed to a large federally regulated bank.

Web The Visa Signature Flagship Rewards Credit Card is a standout offering. Web Advantages to applying for a mortgage with a credit union. Web Three words.

Web In short a credit union mortgage is a debt product you can use to finance a home if you cant afford to pay for it in cash. Web Credit unions may also offer their members lower interest rates than banks. Credit unions may approve lower credit scores.

Web You can literally save hundreds or even thousands of dollars in closing costs insurance vendor fees and other mortgage costs by going with a credit union over a bank. Credit unions are nonprofit which may provide lower rates and fees. Yes you can also take out a mortgage through a bank.

Web When credit funds from a bank borrowing union and other financial institution a person is generally taking that loan. Web In 202021 credit unions provided lower interest rates than banks for 15-year fixed-rate mortgages in all four quarters. Here are some of the best credit unions for VA and FHA loan borrowers first-time home buyers and.

You have to be a member to get one.

Credit Union Vs Bank Mortgage How To Choose Credit Com

Credit Union Vs Bank Mortgage Key Differences Sofi

Top 5 Mortgages Currently Available On The Costa Del Sol

Getting A Mortgage Credit Union Vs Bank Diamond Cu

Credit Union Vs Bank Mortgage Rocket Money

Credit Union Vs Bank Mortgage How To Choose Bankrate

Credit Union Vs Bank Mortgage Home Financing Moneytips

Martel Mortgages Facebook

Kevin Walts Mortgage Sales Manager Associated Credit Union Linkedin

Credit Union Vs Bank Mortgage Home Financing Moneytips

Contact Summit Credit Union

Best In Mortgages Top Loan Experts

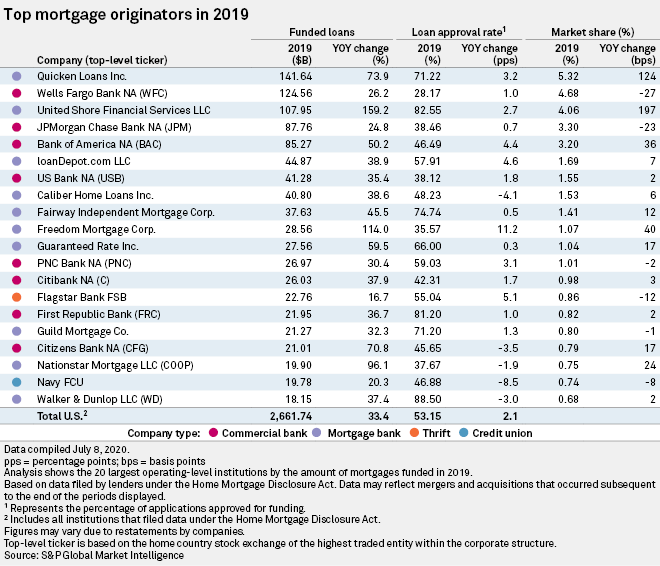

The Business Of Mortgages

The Federal Reserve Doesn T Control Mortgage Rates

Pdf Data Driven Organisations An Evaluation Of The Mortgage Industry In The Netherlands

Credit Union Vs Bank Mortgage Home Financing Moneytips

Rocket Companies Strong Mortgage Play But Valuation Too High Nyse Rkt Seeking Alpha