Net income after taxes calculator

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4.

Paycheck Calculator Take Home Pay Calculator

Other taxable income frequency Annually Monthly Fortnightly Weekly Financial.

. There are two ways to determine your. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. In the financial industry gross and net are two key terms.

Some states follow the federal tax. Your employer withholds a 62 Social Security tax and a. It can be any hourly weekly or.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. The IRS made notable updates to the.

A net loss may be contrasted with a net profit also known as after-tax income or net income. The state tax year is also 12 months but it differs from state to state. This places US on the 4th place out of 72 countries in the.

It can also be used to help fill steps 3 and 4 of a W-4 form. Try out the take-home calculator choose the 202223 tax year and see how it affects. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Yes you can use specially formatted urls to automatically apply variables and auto-calculate. NIAT is frequently used in ratio analysis. Income qnumber required This is required for the link to work.

Net income after tax NIAT is an entitys profits after deducting all expenses and taxes. Your gross salary - Its the salary you have before tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Some money from your salary goes to a pension savings account insurance and other taxes. SARS Income Tax Calculator for 2023. Net Income After Taxes - NIAT.

Your average tax rate is. How to calculate the net salary. Where you live - The municipal.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Is net after tax or before. Net income is the money after taxation.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Net income after taxes NIAT is an accounting term most often found in a companys annual report that is meant to show the companys. After salary sacrifice before tax Employment income frequency Other taxable income.

It is also referred to as bottom-line profitability. That means that your net pay will be 40568 per year or 3381 per month. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

In order to calculate the salary after tax we need to know a few things. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Nopat Formula How To Calculate Nopat Excel Template

Tax Rate Calculator Hot Sale 60 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Net To Gross Calculator

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Calculate Your Net Salary In The Netherlands Undutchables

Net Income Calculator Factory Sale 60 Off Www Alforja Cat

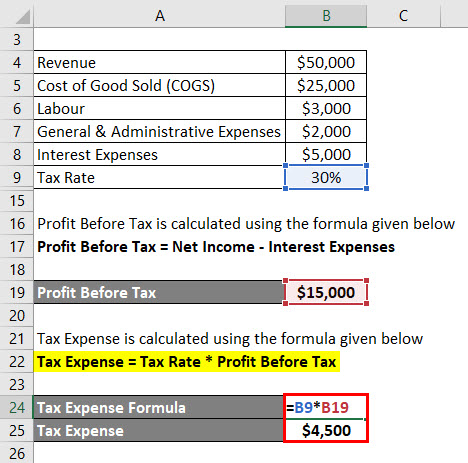

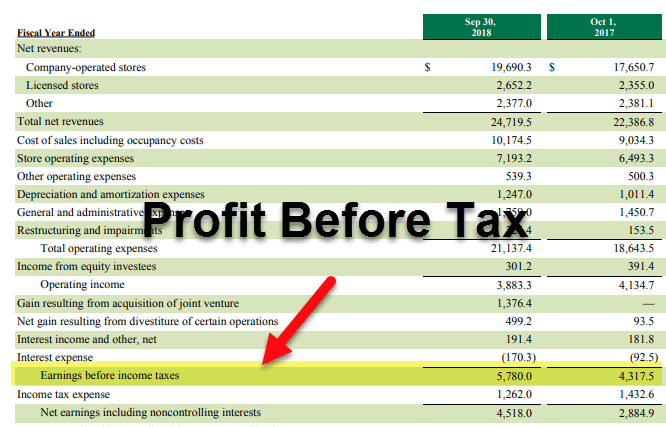

Profit Before Tax Formula Examples How To Calculate Pbt

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Calculating Formula In Excel Javatpoint

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

How To Calculate Income Tax In Excel

60 000 After Tax 2021 Income Tax Uk

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat